State of the Water Industry report shows persistent concerns about funding

June 26, 2025

AWWA Articles

State of the Water Industry report shows persistent concerns about funding

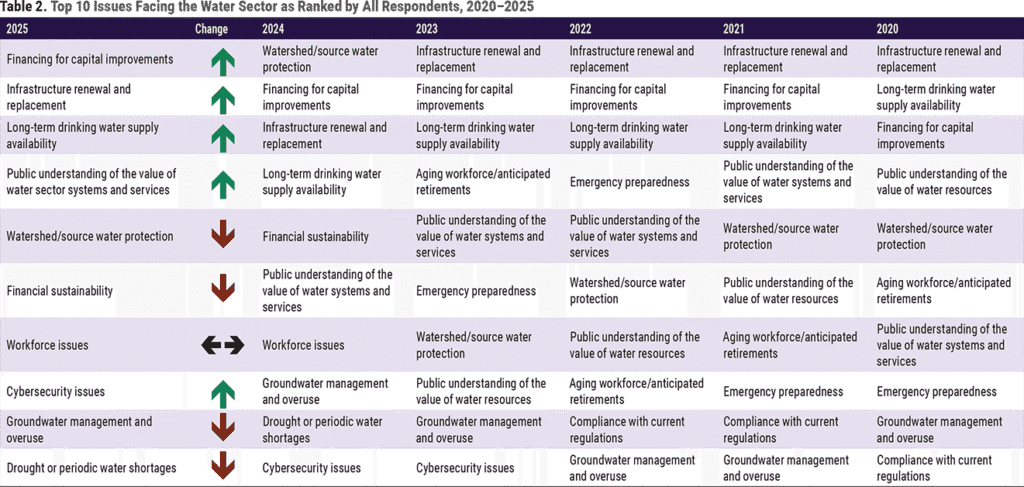

Capital improvement financing remains a top challenge for water utilities, according to a survey of professionals conducted in late 2024.

The 2025 State of the Water Industry, an annual report from the American Water Works Association (AWWA), also found infrastructure improvements and long-term supply to be among the top concerns for industry insiders.

“The cost of providing water service is rising, as the compounding needs to replace aging pipes collides with investments required to meet new regulatory requirements,” said AWWA CEO David LaFrance. “Inevitably, these expenses impact everyone who pays a water bill.”

Regulations surrounding lead and copper and per- and polyfluoroalkyl substances (PFAS) add to the growing financial challenges for utilities. Ideally, revenues from user rates and service charges would be sufficient to cover the cost of providing services, but 30% of utility executives who responded to the survey say they are struggling to meet costs from these sources. This is a change from the previous three years, when more executives indicated they were able to cover costs.

One-quarter of respondents said they would be raising rates this year and about half plan to raise rates in the next two years. Rate increases are most often used to fill funding gaps, according to respondents, before dipping into operational savings or reserves.

Ensuring financial sustainability for water systems will require diverse funding sources that balance the need for infrastructure investment with affordability for customers. Funding challenges in the United States may be exacerbated by potential cuts to State Revolving Funds and Water Infrastructure Finance and Innovation Act loans if U.S. Congress agrees to proposals in the Trump administration’s budget.

“While many water systems across North America have exceeded their design lives, this is our moment to transition from reactive repairs to proactive asset management, rehabilitation, and replacement,” said Heather Collins, AWWA president and assistant group manager of water system operations at the Metropolitan Water District of Southern California.

A total of 3,575 water professionals participated in the survey, which was conducted from Sept. 23 to Nov. 1, 2024. The largest category of respondents represented water sector utilities (64%), followed by those providing goods and services to the water sector (19%).

Respondents were relatively optimistic about the water sector at the time of the survey. An annual question about the health of the industry produced a score of 4.85, modestly above the 22-year average of 4.72.

The report includes much more, including trends in the water sector and other insights from utility executives about their most challenging issues.

See AWWA’s State of the Water Industry page for the executive summary and full report.

Advertisement